Accounts Payable Best Practices to fuel growth, reduce errors and build a fraud-proof department

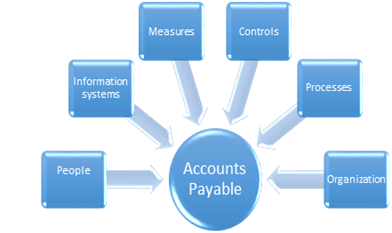

There are many advantages of optimizing your Accounts Payable process. It can increase the effectiveness and efficiency of operations, facilitate reliable financial reporting, and ensure compliance with laws and regulations. An optimized account payable can position you for improved liquidity, mitigate potential funding gaps, and yield higher profits.

On the other hand, companies that ignore accounts payable best practices at their peril let it impact felt on the bottom line. It hampers the company from making timely payments, from taking advantage of the available discounts and from negotiating payments with suppliers.

What about the accounts payable department in your organization? Does it match the world-class standards? What are the must-have technologies for any AP operation? What design best practices will help you fully leverage those capabilities? How can you balance controls with efficiency and create a fraud-proof department? The preceding questions will be answered in the webinar 'Building a World Class Accounts Payable Operation: P2P, AP'.

This article provides Accounts payable best practices for growth, error and fraud prevention.

There is no one-size-fits-all solution to optimizing accounts payable. However, the following best practices lead the way.

Centralize your Accounts Payable processing and reporting

- Create a Shared Services Center: Establish a shared services center (SSC) that handles AP processing for all departments and locations. An SSC can streamline operations, reduce duplication of efforts, and enable better monitoring of the AP process.

- Implement a Standardized Workflow: Develop a standardized workflow for processing invoices, from receipt to payment. This includes defining clear steps for invoice approval, matching invoices to purchase orders, and setting up payment schedules.

- Increased Efficiency: Centralized AP processes eliminate redundancies and improve the speed and efficiency of invoice processing.

- Enhanced Accuracy: Standardization reduces the risk of errors and discrepancies in invoice processing.

- Improved Control: A centralized AP function provides greater visibility and control over the entire payment process, enabling better compliance and fraud prevention.

Senior management, show you genuinely care about the accounts payable function

Adopt robust governance practices

- Segregation of Duties: Ensure that different individuals are responsible for key AP functions, such as invoice approval, payment processing, and bank reconciliation. This prevents a single person from having too much control over the payment process, reducing the risk of fraud.

- Approval Workflows: Implement a formal approval process for all invoices and payments. This includes setting approval limits based on the amount and type of expenditure, and requiring multiple levels of approval for higher-value payments.

- Vendor Management: Regularly review and update the vendor master file to ensure that only authorized and legitimate vendors are included. Implement procedures for adding new vendors, such as requiring verification of vendor information and approval by a designated individual.

- Fraud Prevention: Effective internal controls reduce the risk of fraudulent activities, such as unauthorized payments or vendor fraud.

- Compliance: Strong controls ensure that the AP function complies with company policies, industry standards, and regulatory requirements.

- Accuracy and Accountability: Internal controls help to maintain accurate financial records and provide a clear audit trail for all transactions.

Strengthen the purchase approval process:

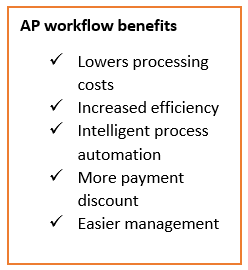

Create Accounts payable management workflows

Consider moving to a paperless environment

Maintain transparency

Establish a Culture of Continuous Improvement

- Regular Process Reviews: Conduct regular reviews of AP processes to identify areas for improvement. This may include analyzing workflow efficiency, assessing internal controls, and evaluating the effectiveness of automation tools.

- Employee Training and Development: Invest in ongoing training and development for AP staff to ensure they have the skills and knowledge needed to perform their roles effectively. This includes training on new technologies, regulatory changes, and best practices.

- Encourage Feedback and Innovation: Create an environment where employees feel encouraged to provide feedback and suggest improvements to AP processes. This can lead to innovative solutions and more efficient workflows.

- Adaptability: A culture of continuous improvement ensures that the AP department can quickly adapt to changes in the business environment, such as new regulations or technological advancements.

- Enhanced Efficiency: Regular process reviews and employee training lead to more efficient operations and reduced processing times.

- Employee Engagement: Encouraging feedback and innovation fosters a sense of ownership and engagement among AP staff, leading to higher job satisfaction and productivity.

Set up supplier master data

Properly manage invoicing process

- To follow a consistent and standardized approach, set up a centralized office for the processing of invoices.

- If there are errors in the invoice, do not proceed with the payments till such time they are corrected.

- Make timely payments as per the internal SLAs (Service level agreements. Also, include a date stamp.

- Without compromising on supplier relationship, ensure you don't process the invoice too early. Pay only when they are due.

- Conduct a management review of the AP aging list to control relevant follow-up actions

- Have relevant channels and process for exception reporting and handling

- Ensure that different individuals in your account team approve purchases, receive ordered supplies, make payments and handle reconciliation.

- Educate suppliers and vendors about your invoicing system and insist on adherence with the invoicing policies

Properly manage the payment process

- Ensure that the invoices are recorded quickly and accurately for payment

- Have a process in place timeframe for approval of invoices

- Have a process in place to verify invoices against supplies

- Have a process in place to resolve disputes

- To avoid extra charges and duplicate payments, ensure you pay close attention to the due dates

- If suppliers offer discounts for early payments, take advantage of them

- If possible make payments using credit cards to ensure tracking of payments in one place and to take advantage of rebates and card spend.

- Pay from original invoices rather than paying from copies to avoid double payment of the same invoices

- Ensure you have the W-9 on file for each supplier before processing payments.

Prevent errors

- Make it easy to weed out errors by providing the relevant staff members access to orders, invoices, payments and other data. With more eyes on the process, correcting errors becomes simpler.

- Provide ongoing education to staff about best practices, about the appropriate use of software program, and account payable systems.

- Avoid batch entries of invoices

- Have an internal audit of your account payable process

Prepare for the Future with Emerging Technologies

- Blockchain: Blockchain technology offers a secure and transparent way to record and verify transactions, reducing the risk of fraud and errors. In the future, blockchain could play a significant role in automating and securing the AP process.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning can be used to enhance fraud detection, automate data entry, and optimize payment strategies. These technologies have the potential to significantly improve the efficiency and accuracy of the AP function.

- Robotic Process Automation (RPA): RPA involves using software robots to automate repetitive tasks, such as data entry and invoice processing. As RPA technology continues to evolve, it will become an increasingly valuable tool for AP departments.

- Increased Security: Emerging technologies, such as blockchain and AI, offer enhanced security features that can protect the AP function against fraud and errors.

- Greater Efficiency: Automation and AI can streamline AP processes, reducing the time and effort required to process invoices and make payments.

- Future-Proofing: By adopting emerging technologies, organizations can ensure that their AP function remains competitive and capable of meeting future challenges.

By centralizing your accounts payable processing and reporting function, employees across the enterprise will have common practices and standards. It facilitates the measurement of performance against established business metrics. It speeds up tasks with fewer resources, thereby reducing the overall enterprise costs. Centralizing accounts payable and reporting helps in eliminating redundancies, errors, and duplication of work. With a centralized accounts payable and reporting process, everyone in the enterprise looks up to accounts instead of having to do multiple inquiries.

Centralization Strategies:

Benefits of Centralization:

The senior management generally understands the importance of the accounts payable function, but generally, in action do not show they recognize it as important. Just because the accounts payable is a backend, don't let it take the back seat. By showing you care about the function, by motivating and by being more involved with accounts payable function, the executive management can show that they truly recognize its importance.

Implementing robust governance practices can significantly alleviate manual errors and bolster internal controls around contract review and accounts payable processing. Financial and time costs are significant when there are errors.

Key Internal Controls for AP:

Benefits of Strong Internal Controls:

To ensure that everyone is meeting the standard operating procedures, keep track of vendor terms, clauses, and agreements. While maintaining scorecards of the performance of the vendors, ensure you monitor data about incoming invoices, payments made, services and products received etc. Thereby, you will be in a better position to manage cash flow more efficiently and identify issues with vendors or accounts payable processes.

Define the level of management authority required to make purchases of different sizes. This can strengthen the purchase approval process. Good collaboration between the purchasing and accounts payable is crucial.

Manually circulating invoices for approval can create processing errors, lost documents, and lost opportunities for early payment discounts. Creating management workflows simplifies transactions, helps in enhancing the efficiency of your accounts payable process. Management workflows help in quickly processing incoming invoices and issuing payments more effectively. It empowers account payable staff to make better decisions in less time.

Account Payable automation systems enable electronic communication with vendors and customers. Such automation systems help you take advantage of available discounts and rebates. An eProcurement system lets you communicate with vendors and customers to raise purchase orders (PO) for every new purchase, electronically qualify and accept invoices, approve requests, track inventories, goods received, and make payments in a timely manner. And then there are options available for you to choose the level of functionality based on specific requirements. Some opt for scanning invoices automatically, tracking delivery receipts and resolving disputes electronically instead of manually following up for resolution.

Without compromising on the security aspects of the information, ensure that the appropriate persons in your organization have access to information about payment terms, discounts, vendors, payments etc. Track information in real time in a secure manner before they cost your organization money.

Continuous improvement is a key principle for building a high-performing AP department. By fostering a culture of continuous improvement, organizations can ensure that their AP processes remain efficient, effective, and aligned with best practices.

Continuous Improvement Strategies:

Benefits of Continuous Improvement:

When you set up a supplier master data, the accounts payable will be helped to determine which suppliers have been approved and ensure that they meet the compliance requirements. Ensure that your supplier master data is diligently scrubbed to examine any flagged or suspect suppliers. This is all the more crucial for larger companies that have hundreds of suppliers. Ensure controls are in place for registration of suppliers to help reduce the risk of fraud. By regularly monitoring the system, you can keep the data accurate and complete. Having inaccurate information on the supplier data can not only waste time but also hamper the smooth payment process to the intended supplier. Hence the importance of a clean supplier management data must never to under-estimated.

The AP landscape is constantly evolving, with new technologies emerging that have the potential to further transform the way AP departments operate. By staying informed about these developments and preparing for the future, organizations can ensure that their AP function remains competitive and innovative.

Emerging Technologies in AP:

Benefits of Emerging Technologies

Attend the seminar 'Account Payable Best Practices ' to understand the newest best practices and ensure that ensure crooks don't get their hands on money or sensitive information. This is one session you might want to invite your colleagues in accounting, auditing and payroll to so they implement appropriate best practices and are not bamboozled by some of the newest frauds. This course is approved by NASBA (National Association of State Boards of Accountancy). Seminar attendees are eligible for 10 CPE credits upon completion of this workshop.

Richard Cascarino,is the Principal of Richard Cascarino & Associates, a highly successful audit training and consultancy company based in Colorado and Johannesburg. He is a regular speaker at National and International conferences and has presented courses throughout Africa, Europe, the Middle East and the USA. Richard is a Past President of the Institute of Internal Auditors in South Africa and also a member of ISACA and the Association of Certified Fraud Examiners. He was a member of the Audit Committee of the Department of Public Enterprises in South Africa and chairman of the Audit Committee of Gauteng cluster 2 (Premier's office, Shared Services and Health). He is the author of the "Auditor's Guide to IT Auditing" and the newly released “Corporate Fraud and Internal Control: A Framework for Prevention” both published by Wiley Publishing which is also used by universities worldwide.