Travel and Expense (T&E) Policy Advantages and Best Practices for the Creation, Management, and Enforcement of the Policy

A Travel and Expense policy is crucial to an organization for many reasons. It improves the bottom line, keeps occupational fraud at bay, streamlines the booking and reimbursement process, and helps comply with IRS regulations. It takes a lot of resources to process expense receipts, verify if the receipts and expense tally, audit, and reimburse the staff for out-of-pocket expenses. A well-defined Travel and Expense (T&E) policy can help simplify the process drastically.

Before you create the travel and expense policy, it is vital to consider three key areas. 1) Understand the IRS regulations 2) Obtain feedback from employees to incorporate it into the policy. 3) Look for a tool to automate the expense management process. Doing so will help you not only to comply with the regulations but also enable a friction-free T&E expense reimbursement.

This article discusses the advantages of creating a T&E policy and presents best practices for the creation, management, and enforcement of the T&E policy.

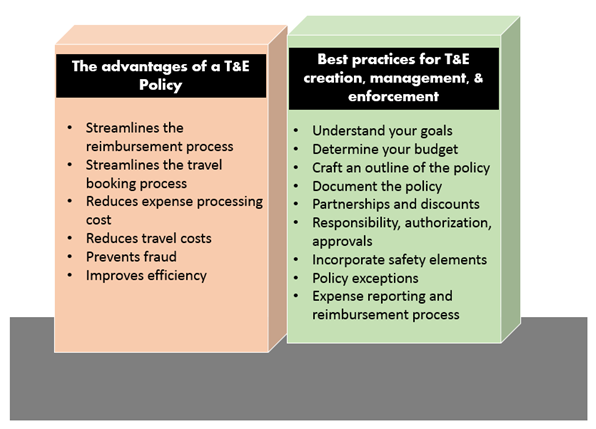

The advantages of T&E policy

Streamlines the reimbursement process - A well-defined T&E policy streamlines the reimbursement process. When the T&E expense report has been approved by the employee's supervisor and sent to accounts payable, the accounts payable staff is responsible for reviewing the report and processing the reimbursement for the out-of-pocket expenses. Based on the organization's philosophy, the responsibility for monitoring the expense report may rest on the accounts payable group. Some organizations have another reimbursement function - The prepayment option where in the cash is given in advance. When employees understand the reimbursement process, a hassle-free reimbursement process is facilitated.

Streamlines the travel booking process - Best-in-class companies use creative approaches to travel booking processes. For example, they i take into consideration employee satisfaction by focusing more on improving the booking and travel experience for employees. They do so by inviting traveler feedback and use that feedback to shape future policy and vendor decisions. Another creative approach to streamlining the booking process and enhancing traveler satisfaction is to empower staff with a booking engine that takes their personal preferences into consideration without losing focus on the corporate travel policy.

Saves cost-

Expense processing cost - As mentioned at the outset of this article, it takes a lot of attention and resources to process receipts, verify if the receipts match with the expense report, audit, reimburse employees for out of pocket expenses and manage the entire process. By improving the T&E policy, much of the unnecessary recurring cost of expense-processing can be reduced, thereby improving the bottom line.

Travel costs - When you analyze the key trends from the spend data and the vendor in the electronic system, you can go back to the vendors to negotiate the cost. A decent volume of data helps you reduce your T&E cost by approximately 8-10% across hotels and airline.

Prevents fraud - According to the Report to the Nations, in 75.6% of expense reimbursement schemes, the perpetrator was also undertaking at least one other form of occupational fraud (one of the most respected fraud surveys conducted by the Association of Certified Fraud Examiners). Understanding the red flags of possible reimbursement fraud will prove to be invaluable in fraud prevention. Setting standards for expense reimbursement helps in preventing fraud.

Improves efficiency - Employees who are well-informed about what they should and shouldn't do will not keep calling the policy administrators to check how to do something. Having a standardized policy helps in keeping employees informed. It is crucial to establish a policy early even if the Company is small. Eventually, it can be tweaked based on how It works and employee feedback and can be easily scaled across new locations and new employees.

Best Practices for T&E policy creation, management, and enforcement

Understand your T& E goals

Every successful endeavor starts with goals. Some of the important goals of the T& E policy are:

- To comply with the regulatory requirement of the IRS. The IRS guidelines are on the IRS website. For an intensive review of what the IRS requires of an expense reimbursement policy in order for your company to maintain an accountable plan register here.

- To define the process for employees and non-employees including how to report expense, what to include, and how the reimbursement is done.

- To make sure that everyone involved understand their obligations and responsibilities with respect to expenses.

- To ensure that the employees know how to spend company money responsibly

- To improve the safety of employees

- Reduce risk for the company and employees

Determine your Budget

Before writing and implementing standards for your T&E policy, it is important to determine the threshold your organization is willing to spend on T&E. To determine a budget, use the following steps:

- Review previous travel expenditure

- Provide a cushion for unforeseen and unplanned travel needs

- Examine previous travel

- Analyze expense category averages

- Find out about travel needs by talking to the employees

- Make adjustments as needed

- Consider outside sources such as benchmark reports

Craft an outline of the T&E policy

Below is an outline to inform your policy development process. You can customize this to fit your specific policies to best fit the needs of your organization.

Common elements of a T&E policy:

- Introduction

- Travel partners and discounts

- Responsibility, Authorization, and Approvals

- Safety information for travelers

- Safety Information required of travelers (contact information, travel insurance, itineraries)

- Policy requirements

- Expense reporting and reimbursement process

- Reimbursable expenses

- Non-Reimbursable items

Document the Policy

Now that you have completed the basic steps to crafting a T&E policy, it's time to start writing the policy.

What to include in the introduction

As crucial as the policy is, is the articulation of the policy. Companies that explain the need for a policy have greater success than those that simply create policies without giving out the reasons. To set stage for the policy document, include the following in the introduction.

- Overview of the document

- The objectives of the policy

- How the policy is meant to help travelers and employees

- Recommendations and general expectations for travelers such as taking advantage of discounts, utilizing travel partners, obtaining reasonable rates for travel and lodging

- Disclaimers

- How adherence to the policy benefits the employees and the company

Travel partners and discounts

In this section of the policy, summarize all the existing partnerships and discounts available to your company. It will serve as a good start for travelers seeking travel and discount information and also assist you to meet the goals of the company's travel policy and budget. Ensure that this section is most up-to-date.

Responsibility, Authorization, and Approvals

Simplicity is the key to the user adoption of the policy. As part of the policy, remind the employees that approvals are required by authorized personnel within the organization before booking the travel. By keeping the number of authorizations to a minimum, travelers are more likely to adopt the policy.

Incorporating the Safety element

As part of the corporate social responsibility, it is important to ensure the safety and security of employees. Ensure that your T&E policy accounts for the measures the company has in place to ensure safety. Also, include the specific laws and compliance regulations that apply to your company and the processes to be followed for compliance.

Policy exceptions

Policy exceptions greatly vary between companies. For example, your Company may have higher spending limits to employees that travel more than 6 hours or employees who have to stay away for over a week etc. Also, your company may have a special executive-level policy which is communicated exclusively communicated to the executives. Whatever the exceptions, ensure that your policy accounts for the exceptions.

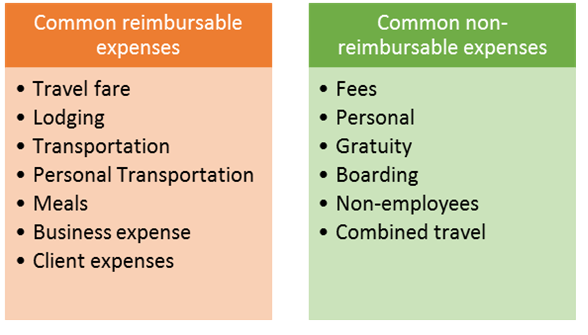

Expense reporting and reimbursement

This section is the core of your T&E policy. While laying out the process in detail, It is important to set a standard on what item will be reimbursed and what will not be reimbursed and communicate it clearly in the policy.

Some of the most common reimbursable and non-reimbursable expenses are in the table below:

Attend the seminar 'Expense Reporting and Best Practices' to take a deep dive into the topic. This seminar will examine the best practices as they relate to the expense reimbursement process; practices that will not only keep your Travel & Entertainment (T&E) expenses in control but will also keep you in compliance with IRS regulations. The seminar will identify other best practices every organization needs to use in order to have an effective policy. Also, the data showing exactly what other companies are doing with regards to expense reimbursements will be examined.

The speaker, Mary S. Schaeffer, is a nationally-recognized account payable expert, and the author of 18 business books, a monthly newsletter, and a free bi-weekly e-zine, as well as several CPE courses for CPAs. She runs AP Now, a boutique publishing and consulting firm focused on accounts payable issues. She also serves as the Education Director for the Institute of Financial Operations. Before turning to writing and consulting she worked in the corporate world as an Assistant Treasurer for the Equitable Life Assurance Society, a Financial Risk Manager for O&Y and a Corporate Cash Manager for Continental Grain. A frequent and popular speaker at both live and online events, she has an MBA in Finance and a BS in Mathematics.