By using this site you agree to our use of cookies. Please refer to our privacy policy for more information. Close

Code Name Prometheus aka The Panama Papers

- By: Staff Editor

- Date: April 13, 2016

- Source: ComplianceOnline

Code Name Prometheus aka The Panama Papers

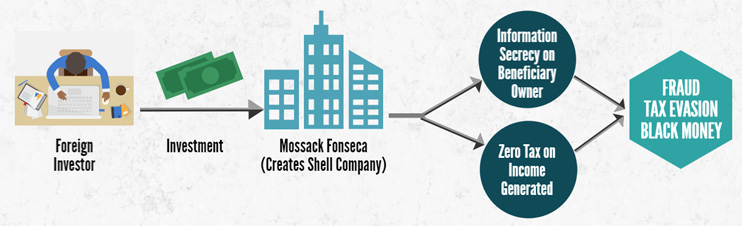

It has all the trappings of a spy thriller – an offshore corporation that creates shell companies for wealthy investors to evade tax, the big names involved, and a band of journalists hot on their trail for over a year. Pushing past WikiLeaks and Edward Snowden, the Panama Papers now leads as the biggest whistleblower in history – with over 2.6 terabytes of data to quantify it.

An Anonymous Source for a German Newspaper

“Interested in data?” a John Doe enquired of Süddeutsche Zeitung, a Munich-based newspaper.

“We’re very interested,” replied Bastian Obermayer, their savvy financial scandals investigator. And thus began the cryptic communication that escalated to 11.5 million files shared over the next few months. The still-anonymous source went onto furnish the newspaper with emails, photographs, invoices, scanned letters and client data from the servers of Mossack Fonseca, a Panamanian law firm that specializes in creating shell companies and offshore bank accounts for its elite clientele.

Overwhelmed by the quantum of data to dissect, the newspaper reached out to the International Consortium of Investigative Journalists (ICIJ) for help. The ICIJ soon created a network of around 400 journalists from over 80 countries to help process and validate the information they received, christening their project Prometheus.

The Titans in the Tale

Some of the Panama paper trail has been traced back to mighty origins. From presidents and emperors to soccer stars and sports federations, the documents have dragged to light plenty of public figures to add to the controversy. In all, the leaks have revealed ties to 12 national leaders including presidents, monarchs, prime ministers and 128 other politicians or public figures.

It’s Not Completely Illegal

The cover of secrecy that these shell companies offer can give rise to a lot of unethical practices such as tax evasion or money laundering. But, holding money in an offshore company is generally not illegal by itself.

In many cases, there are reasons why you have to opt for such ventures:

Some countries have laws that allow only citizens to own lands or property; they may make exceptions for locally registered companies. A foreigner looking to invest in a vacation or retirement home may set up a local shell company to purchase property.

Businesses establishing joint ventures in countries with fragile or corrupt legal systems often do so through offshore companies based in places like the Cayman Islands or the British Virgin Islands. This set-up allows the business to operate under more stringent laws and with access to a better legal system.

Business owners from countries like Russia and Ukraine may opt to maintain their assets offshore to secure them from illegal or criminal “raids”, or to sidestep rigid currency restrictions.

Tax Havens – Regulatory Measures

Tax havens – while the term resonates with promise of illicit transactions, they are often used lawfully, and anonymously, to hold property and bank accounts. The privacy offered by these ventures though raises quite a few red flags, which means regulators want a better look at the chain of financial transactions that lead to these offshore accounts.

Multinational companies are considered particularly well-positioned to exploit tax havens in an effort to maximize shareholder value. Following the Panama Papers leak, the European Union has stepped in with a revision to its proposal for multinationals to publish profits and tax bills generated in tax havens.

Since January 2014, FATCA (Foreign Account Tax Compliance Act) requires foreign financial institutions (FFIs) to provide yearly reports to the IRS (Internal Revenue Service) with details of the name and address of each U.S. client and the largest account balance in the year.

The tightening reigns and reforms now push for transparency in transactions in a bid to rescind the key advantage most tax havens offer – the cloak of invisibility.

Additional Resources:

Webinar on Panama Papers and PEP Screening – KYC & Sanctions Filtering

Compliance Trainings

By - Peter Goldmann

On Demand Access Anytime

By - Ray Graber

On Demand Access Anytime

Compliance Standards

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

-

By: Miles HutchinsonAdd to CartPrice: $249

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

-

Add to CartSan Francisco, CA | Aug 6-7, 2020

-

Add to CartVirtual Seminar | Jul 16-17, 2020

-

Add to CartVirtual Seminar | Jun 18-19, 2020

-

Add to CartLos Angeles, CA | Aug 20-21, 2020

-

Add to CartVirtual Seminar | Jul 16-17, 2020

-

Add to CartVirtual Seminar | Jun 25-26, 2020

-

Add to CartVirtual Seminar | Jun 10, 2020

-

Add to CartVirtual Seminar | Jun 3-4, 2020

-

Add to CartVirtual Seminar | Jul 6-7, 2020

-

Add to CartSan Francisco, CA | Oct 22-23, 2020

-

Add to CartVirtual Seminar | Jul 9-10, 2020

-

Add to CartVirtual Seminar | Jun 3-4, 2020

-

Add to CartVirtual Seminar | June 3-4, 2020

-

Add to CartMiami, FL | Jul 29-31, 2020

-

Add to CartVirtual Seminar | Jun 17, 2020

-

Provider: ANSIAdd to CartPrice: $142

- Add to Cart

- Add to Cart

- Add to Cart

-

Provider: ANSIAdd to CartPrice: $120

-

Provider: ANSIAdd to CartPrice: $250

-

Provider: SEPTAdd to CartPrice: $299

- Add to Cart

-

Provider: Quality-Control-PlanAdd to CartPrice: $37

- Add to Cart

-

Provider: At-PQCAdd to CartPrice: $397

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart