By using this site you agree to our use of cookies. Please refer to our privacy policy for more information. Close

Understanding Compliant HCC Coding and Auditing

- By: Staff Editor

- Date: August 11, 2018

Compliance Webinars | Virtual Seminars for Professionals

There's a lot of buzz around HCCs in the healthcare. But not everyone understands why and how to use them. Coding and auditing errors can have a negative impact on the organizations revenue cycle. Hospital and clinical staff, including Directors, Auditors, CDI staff, Managers, CDI Clinicians and coding compliance and privacy staff should understand the key components of the HCC coding and auditing.

Coding Guidelines

ICD-10-CM Official Guidelines for Coding and Reporting FY 2018

What is Hierarchical Condition Categories (HCC)?

Gone are the days when the insurance companies offered low-cost insurance plans to the healthy patients who hardly visit the doctor and high-cost insurance plans to the frequently ill patients. Thanks to the Affordable Care Act (ACA). Its premise is to make affordable health coverage plans available to everyone.

This is made possible with Hierarchical Condition Categories (HCC), a risk adjustment model. This model is existing for years but has gained prominence since Medicare Advantage Plans began to require RAF (Risk Adjustment Factor) scores for reimbursement. Today coding leaders and commercial payers have to be well acquainted with this model to ensure compliance and fair reimbursements.

The Risk Adjustment (RA)

Risk Adjustment is a statistical process that takes into account the underlying health status and health spending of the enrollees in an insurance plan when looking at their health care outcomes or health care costs.(Healthcare.gov)

Under risk adjustment, an insurer who enrolls a greater-than-average number of high-risk individuals receives compensation to make up for extra costs associated with those enrollees.(AAPC)

A variety of factors come into consideration while determining the risk/work to maintain the patient’s health. Based on this, two patients in the same practice may have different payment rates in the RA model.

By assessing the cumulative risk of each patient, and setting aside a certain a certain sum of money to his or her care, the RA payment model enables insurance companies to provide quality and affordable health plans no matter what the status of the patient health is. HCC plays a part in exactly how patients are assigned the RAF score.

Hierarchical Condition Categories (HCC)

HCCs are used by CMS to reimburse Medicare Advantage plans based on the health of their members. The payment is made as per the predicted cost expenditure of patients by adjusting those payments based on the health status of patient and demographic information. The diagnosis information collated from claims and medical records collected by physician offices, hospital inpatient visits and in outpatient settings forms the basis for the Risk assessment data.

Diseases and conditions are organized into body systems or similar disease processes. The top HCC categories include:

HCC Models

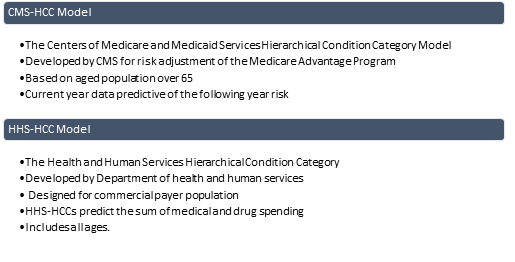

There are two types of HCC models CMS-HCC and HHS-HCC. The differences are below:

Figure 2Two Types of HCC Models

Purpose of the CMS-HCC Model:

To promote fair payments to Medicare providers and Medicaid managed care organizations by rewarding efficiency and encouraging the delivery of outstanding care for chronically ill.

Purpose of the HHS-HCC Model:

To lessen or eliminate the influence of risk selection on the premiums that plans charge.

HCCs are used with:

- Medicare Advantage Plans

- Medicare Shared Savings ACO (expected cost)

- Value-Based Purchasing (expected cost/efficiency)

- Some Commercial ACOs/Shared Risk arrangements

- Health Insurance Exchange Plans

- States Where Medicare/Medicaid Dual Eligible are Managed Care and

- Population Health/Risk Stratification/Cost Prediction

Best practices in compliant HCC coding

Code and bill accurately in accord with physician documentation and in compliance with regulations and coding guidelines. These guidelines act as a set of rules to accompany and complement the official conventions and instructions given within the ICD-10-CM. The instructions and conventions of the classification take priority over guidelines. The Health Insurance Portability and Accountability Act (HIPAA) requires adherence to these guidelines when assigning ICD-10-CM diagnosis codes.

- Proactively identify chronic patients with HCC gaps.

- Schedule these patients for care.

- Alert physicians within their workflows to ensure documentation is complete

- Stay current with regulatory updates

- Understand the Government focus

- Thoroughly review documents

- Perform ongoing reviews and education

Auditing Resources

- Medicare Manual - Manuals that offers day-to-day operating instructions, policies, and procedures based on statutes and regulations, guidelines, models, and directives.

- OIG Work plan. The OIG Work Plan presents the audits and evaluations conducted by the Office of the Inspector General to assist the Board of Governors of the Federal Reserve System (Board) and the Bureau of Consumer Financial Protection (Bureau) in fulfilling their respective missions.

- CMS Compliance Program Guidance for Medicare Fee-for-Service Contractors

- CMS Transmittals and MedLearn Matters

- IPPS Final Rule - The purpose of this rule is to further advance the agency’s priority of creating a patient-centered healthcare system by achieving greater price transparency, interoperability, and significant burden reduction so that hospitals can operate with better flexibility and patients have what they need to be active healthcare consumers

- AHIMA Practice Brief on Compliant Queries

- AHIMA’s Code of Ethics

- Latest organizational coding guidance memos, policies and procedures (must NOT contradict with coding guidelines)

To summarize: Understanding quality coding and auditing is essential to ensuring your organization’s compliance to regulatory requirements including risk-adjusted payers. By getting a grasp of Hierarchical Condition Categories (HCCs) and applying coding guidelines, you will be ensuring fair reimbursements and revenue.

Take a deep dive into Compliant HCC coding and Auditing

To know more, to practice and review case examples involving HCC coding and auditing, and accurately identify HCC coding and auditing errors, you may wish to attend the webinar ‘Compliant HCC Coding and Auditing - What you need to know?. The instructor Victoria is an RHIA (Registered Health Information Administrator), a Clinical Documentation Improvement Practitioner (CDIP), Certified Coding Specialist (CCS), a Certified Coding Specialist Physician-Based (CCS-P) and an AHIMA-Approved ICD-10-CM/PCS Trainer with over 24 years’ experience in the healthcare field.

You may also wish to browse through our library of healthcare compliance webinars.

Trending Compliance Trainings

By - Roger Cowan

On Demand Access Anytime

By - Doug Keipper

On Demand Access Anytime

By - Joy McElroy

On Demand Access Anytime

By - Carolyn Troiano

On Demand Access Anytime

By - Dr. Afsaneh Motamed Khorasani

On Demand Access Anytime

By - Michael Ferrante

On Demand Access Anytime

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

-

By: Miles HutchinsonAdd to CartPrice: $249

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart

-

Add to CartSan Francisco, CA | Aug 6-7, 2020

-

Add to CartVirtual Seminar | Jul 16-17, 2020

-

Add to CartVirtual Seminar | Jun 18-19, 2020

-

Add to CartLos Angeles, CA | Aug 20-21, 2020

-

Add to CartVirtual Seminar | Jul 16-17, 2020

-

Add to CartVirtual Seminar | Jun 25-26, 2020

-

Add to CartVirtual Seminar | Jun 10, 2020

-

Add to CartVirtual Seminar | Jun 3-4, 2020

-

Add to CartVirtual Seminar | Jul 6-7, 2020

-

Add to CartSan Francisco, CA | Oct 22-23, 2020

-

Add to CartVirtual Seminar | Jul 9-10, 2020

-

Add to CartVirtual Seminar | Jun 3-4, 2020

-

Add to CartVirtual Seminar | June 3-4, 2020

-

Add to CartMiami, FL | Jul 29-31, 2020

-

Add to CartVirtual Seminar | Jun 17, 2020

-

Provider: ANSIAdd to CartPrice: $142

- Add to Cart

- Add to Cart

- Add to Cart

-

Provider: ANSIAdd to CartPrice: $120

-

Provider: ANSIAdd to CartPrice: $250

-

Provider: SEPTAdd to CartPrice: $299

- Add to Cart

-

Provider: Quality-Control-PlanAdd to CartPrice: $37

- Add to Cart

-

Provider: At-PQCAdd to CartPrice: $397

- Add to Cart

- Add to Cart

- Add to Cart

- Add to Cart